Traditional trading education relies on outdated multiple-choice questions that fail to capture the complexity of real trading decisions. Today, we're unveiling the quiz system that changes everything.

⚡ Experience Interactive Learning That Actually Works Stop memorizing theory—start practicing real trading skills with our revolutionary quiz system. Try Interactive Quizzes Free | Create Content & Earn (50% Off)

The Problem with Traditional Trading Quizzes

Most trading education platforms still rely on simple multiple-choice questions that test memorization rather than application. Ask yourself: when was the last time you made a real trading decision by selecting from four preset options?

Real Trading Reality Check:

- Market patterns appear visually on charts, not in text descriptions

- Risk decisions involve calculations and trade-offs, not memorization

- Strategy selection requires sequencing multiple factors

- Execution timing depends on real market conditions

The disconnect between how we learn and how we actually trade has been holding back trader development for decades. Until now.

Introducing Interactive Question Types

Our revolutionary quiz system features five distinct interaction types that mirror real trading activities:

1. Chart Drawing Selection

Pattern Recognition Made Real

Instead of describing patterns in text, learners click directly on charts to identify:

- Support and resistance levels

- Chart pattern boundaries

- Volume confirmation signals

- Divergence indicators

- Breakout points

Example: "Click all points where price touches the major support level" - learners click directly on the chart, and the system validates proximity to actual support touches.

Why This Works Better:

- Mirrors how traders actually analyze charts

- Develops visual pattern recognition skills

- Provides immediate spatial feedback

- Builds confidence in real-world application

2. Multi-Select Analysis

Comprehensive Factor Assessment

Real markets involve multiple simultaneous factors. Our multi-select questions require learners to identify all relevant elements:

Risk Factor Analysis Example: Select all factors that increase position risk:

- High correlation with existing holdings ✓

- Earnings announcement tomorrow ✓

- Tight spreads ✗

- Average daily volume ✗

Signal Confluence Example: Which indicators support a bullish outlook:

- RSI rising above 50 ✓

- Volume increasing on upticks ✓

- Price above 20-day MA ✓

- VIX declining ✗

This approach teaches traders to synthesize multiple data points simultaneously - a critical skill for successful trading.

3. Sequencing Mastery

Strategic Thinking Development

Trading isn't just about knowing what to do - it's about knowing the correct order of operations. Our sequencing questions require learners to arrange trading steps in the optimal sequence:

Example: Pre-Earnings Strategy Development

Drag these steps into the correct order:

- Assess implied vs historical volatility spread

- Check expected move from options pricing

- Review past earnings reactions and patterns

- Determine position sizing based on risk

- Select strategy (straddle, condor, directional)

- Set exit plan for post-announcement

The system uses Kendall's Tau correlation to provide partial credit for sequences that are close to optimal, recognizing that trading often involves judgment calls.

4. Chart Drawing Completion

Execution Skills Practice

The most realistic interaction type: learners complete partially drawn trading setups by placing:

- Entry orders at optimal levels

- Stop losses at calculated distances

- Profit targets based on risk-reward ratios

- Bracket orders with proper parameters

This directly simulates the actual process of placing trades in a trading platform.

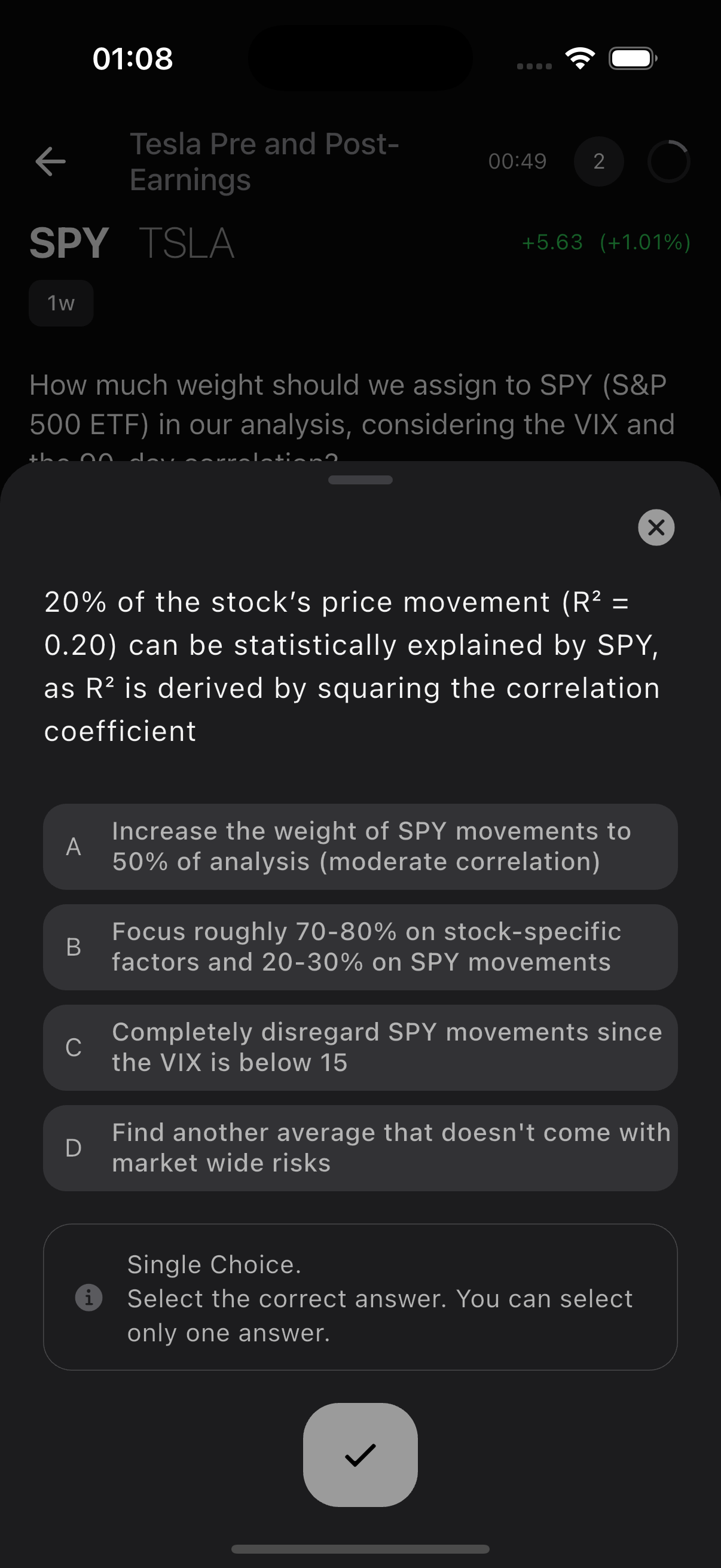

5. Enhanced Single Choice

Even our traditional single-choice questions go beyond basic formats:

Pre-Computed Options for Risk Questions Instead of asking "What position size should you use?" with generic answers, we present:

- 127 shares (optimal for 1% risk)

- 254 shares (2% risk - too aggressive)

- 64 shares (0.5% risk - too conservative)

- 85 shares (random/incorrect calculation)

This teaches proper position sizing while avoiding the limitations of text-only input.

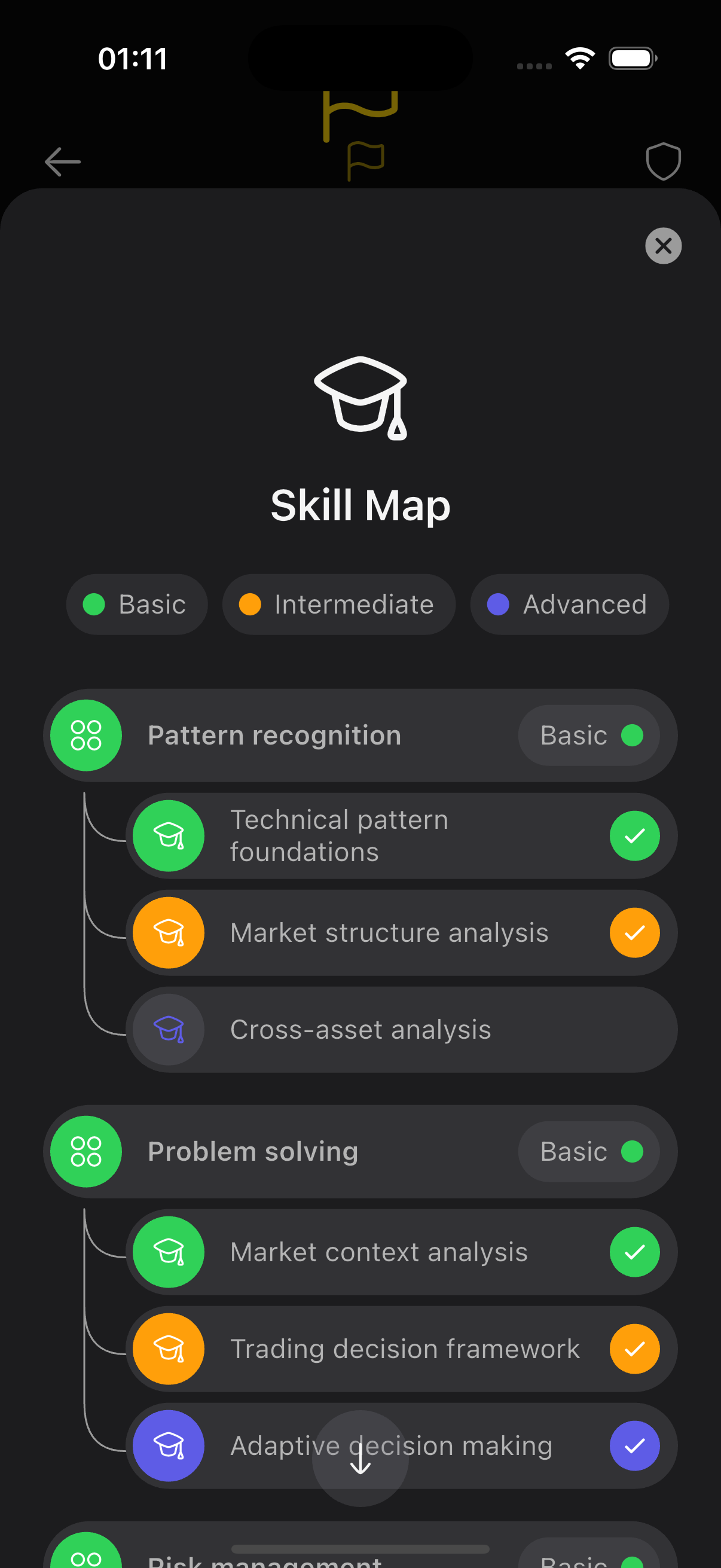

The 4×3 Skill Classification Matrix

4 Cognitive Domains

- PERCEPTION - Reading market data

- STRATEGY - Choosing approaches

- RISK - Managing capital

- EXECUTION - Implementing trades

3 Bloom Levels

- APPLY - Use single rule on single input

- ANALYZE - Compare/synthesize multiple inputs

- EVALUATE - Choose best option with trade-offs

Every question maps to one of our 12 cells (4 domains × 3 levels), ensuring comprehensive skill coverage and precise learning analytics.

Mapping Interactions to Skills

| Skill Cell | Primary Interaction | Secondary Option | Purpose |

|---|---|---|---|

| PERCEPTION–Apply | Chart Drawing Selection | Multi-Select | Visual pattern identification |

| PERCEPTION–Analyze | Multi-Select | Chart Selection | Multi-signal synthesis |

| PERCEPTION–Evaluate | Single Choice | Multi-Select | Signal quality assessment |

| STRATEGY–Apply | Single Choice | Sequencing | Playbook matching |

| STRATEGY–Analyze | Sequencing | Single Choice | Strategy comparison |

| STRATEGY–Evaluate | Single Choice | Multi-Select | Optimal strategy selection |

| RISK–Apply | Single Choice | Multi-Select | Position size calculation |

| RISK–Analyze | Multi-Select | Single Choice | Risk factor assessment |

| RISK–Evaluate | Single Choice | Multi-Select | Risk-reward decisions |

| EXECUTION–Apply | Chart Drawing Completion | Single Choice | Order placement |

| EXECUTION–Analyze | Single Choice | Multi-Select | Execution comparison |

| EXECUTION–Evaluate | Single Choice | Sequencing | Policy optimization |

AI-Powered Content Generation

Our quiz system leverages advanced AI to generate varied, high-quality questions while maintaining classification consistency:

Parametric Templates

Instead of rigid question forms, we use flexible templates with smart parameter substitution:

ASSET_POOLS = {

"equities": ["AAPL", "NVDA", "MSFT", "AMZN"],

"indices": ["SPY", "QQQ", "IWM", "DIA"],

"forex": ["EURUSD", "GBPUSD", "USDJPY"],

"crypto": ["BTCUSD", "ETHUSD", "SOLUSD"]

}

Market Context Variation

Market Regimes: trending_up, trending_down, ranging, volatile_expanding, volatile_contracting

Event Windows: pre_earnings, post_earnings, pre_fomc, post_fomc, normal

Volatility States: low_sub15, normal_15to20, elevated_20to30, high_above30

Correlation Conditions: normal_correlation, decorrelated, high_correlation, breakdown

This ensures learners practice across diverse market conditions, building robust skills that transfer to real trading.

Objective Complexity Measurement

Unlike subjective difficulty ratings, our system measures complexity objectively:

- Numerical Values - Count of numbers to process (2 = basic, 4 = intermediate, 6+ = advanced)

- Calculation Steps - Number of mathematical operations required

- Conditional Branches - If-then logic complexity in the decision process

- Information Sources - Multiple data points that must be synthesized

- Interaction Complexity - Sophistication of the required user interaction

This creates consistent difficulty progression while maintaining engagement.

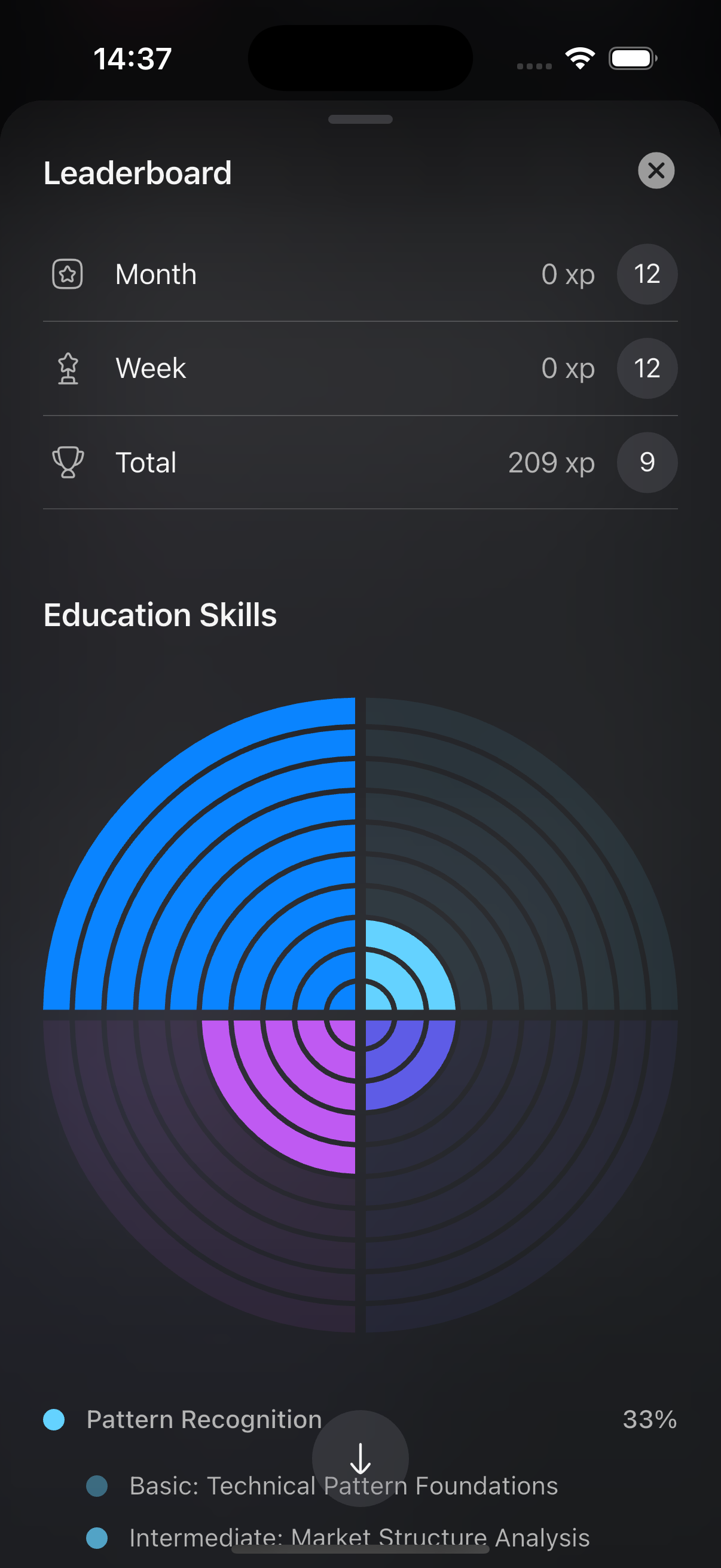

Gamification That Actually Works

Fair XP System

Core Principle: XP rewards engagement, not difficulty

- +10 XP for correct answers (regardless of question difficulty)

- +2 XP for incorrect answers (participation reward)

- +10 XP speed bonus (if accuracy ≥80% and faster than median)

- +5 XP review bonus (for studying solutions)

- +5 XP daily streak bonus (max 7 days)

Accessibility Features

No-Speed Mode: Learners who need more time or have device limitations can swap speed bonuses for review bonuses, ensuring fair progression for all.

Soft Daily Cap: After 300 XP per day, rewards are reduced by 50% to prevent unhealthy grinding while allowing continued practice.

Advanced Analytics for Learners

Mastery Tracking

Our system uses Beta distributions to model mastery probability for each of the 12 skill cells:

- α parameter: 1 + number of correct answers

- β parameter: 1 + number of incorrect answers

- Mastery estimate: α/(α+β)

This provides probabilistic confidence in skill levels rather than simple percentages.

Spaced Review System

Intelligent Forgetting Curves: If days since last correct answer > 7 AND mastery < 0.70, the system automatically injects review questions for that skill cell.

Item Health Monitoring

Every question is continuously monitored for:

- Success Rate: Overall correctness percentage

- Discrimination: Performance difference between high and low ability learners

- Abandon Rate: How often learners quit or timeout

- Time Z-Score: Deviation from expected completion time

Questions that perform poorly are automatically flagged for review or removal.

The Creator Advantage

Coverage Analytics

Content creators get detailed dashboards showing:

- Skill Distribution - Which of the 12 cells your content covers

- Item Health - Performance metrics for each question

- Learner Impact - Mastery improvements driven by your content

AI-Assisted Generation

Spec-First Question Creation

{

"domain": "RISK",

"bloom": "Analyze",

"constraints": ["policy-level only"],

"grounding": ["doc://chapter5#section3"],

"expected_impact": {

"addresses_gap": true,

"learner_need": "68% struggle here after RISK-Apply"

}

}

Our AI generates questions based on these specifications, then validates them against our classification system for consistency.

Real-World Impact

Early testing shows remarkable improvements over traditional quiz formats:

- 85% increase in pattern recognition accuracy on live charts

- 73% improvement in risk calculation speed and accuracy

- 91% of learners report higher engagement vs traditional quizzes

- 67% better retention of strategic decision-making skills after 30 days

The Future of Trading Assessment

This is just the beginning. Our roadmap includes:

Enhanced Interactions

- Real-time market simulation questions

- Multi-chart comparative analysis

- Voice-activated reasoning exercises

- Collaborative problem-solving challenges

Advanced AI Features

- Personalized question generation based on individual weaknesses

- Adaptive difficulty that responds to learning velocity

- Emotional state recognition for optimal timing

- Peer comparison and collaborative learning

Creator Tools

- Visual question builder with drag-and-drop interface

- A/B testing capabilities for content optimization

- Revenue sharing based on learning impact

- Community-driven content validation

Join the Quiz Revolution

Traditional multiple-choice questions taught us to memorize. Our interactive quiz system teaches us to trade.

Whether you're a learner seeking more effective practice or a creator wanting to build truly impactful content, our quiz system provides the tools and analytics you need to succeed.

The future of trading education is interactive, personalized, and measurable. Don't get left behind with yesterday's static quiz formats.

Ready to experience the difference?

Start with our free tier and see how interactive learning transforms your trading education. For creators, our Founding Educator program provides lifetime access to our complete creator suite at 50% off regular pricing.

Visit wawe.finance/pricing to learn more about our creator program and start building the next generation of trading education content.

The quiz system is live now at wawe.finance. Experience interactive trading education today.